# API Policy

Source: https://docs.greip.io/api-policy

Greip API Updates & Deprecation Policy

## 1. Overview

This policy outlines Greip’s approach to API updates, versioning, and deprecation. It ensures a smooth transition for developers when changes are introduced and provides clear guidelines on how long older versions will be supported before they are phased out.

By using the Greip API, you agree to stay informed about updates and adjust your integration accordingly to maintain compatibility.

## 2. API Versioning & Updates

Greip follows a versioned API approach to maintain stability while introducing improvements. Versions are structured as:

```

v[Major].[Minor].[Patch] (Example: v1.2.3)

```

* Major Updates (vX.0.0)

* Introduce significant changes, including breaking changes that may require code adjustments.

* Announced at least 2 months before deprecation of the previous major version.

* Minor Updates (vX.Y.0)

* Add new features or improvements without breaking existing functionality.

* Recommended but not mandatory for users to upgrade immediately.

* Patch Updates (vX.Y.Z)

* Contain bug fixes, security enhancements, and performance optimizations.

* Automatically applied and require no action unless otherwise stated.

Developers should integrate with the latest stable version to benefit from performance, security, and feature improvements.

## 3. Deprecation & Sunset Policy

To ensure long-term reliability, Greip may deprecate older API versions when necessary. The deprecation process follows these steps:

### 3.1 Deprecation Announcement

* Deprecation notices will be communicated via:

* Greip API Documentation (docs.greip.io)

* Email notifications (for registered users with active API keys)

* Dashboard alerts (if applicable)

* The notice period for deprecation depends on the impact of the change:

* Major version deprecation: Minimum 2 months notice before end-of-life.

* Minor version deprecation: Minimum 2 months notice.

* Patch versions are not deprecated individually unless a security issue arises.

### 3.2 Sunset Phase (End-of-Life)

* After the deprecation period, the API version will be officially sunset and no longer accessible.

* Requests to deprecated versions may return HTTP 410 (Gone) or be redirected to the latest version if possible.

* API keys using outdated versions will not be disabled but will no longer work with the deprecated endpoints.

## 4. Mandatory Migrations

Certain updates may require developers to migrate to a newer API version. This happens when:

* Security vulnerabilities exist in the deprecated version.

* Underlying technology dependencies are no longer supported.

* A major architectural change is introduced.

Developers are expected to proactively update their integrations to avoid disruptions. Greip will provide migration guides and technical support during transitions.

## 5. Backward Compatibility & Grace Periods

* Non-breaking changes (e.g., new parameters, additional fields) will be introduced without affecting existing integrations.

* Breaking changes (e.g., removal of fields, altered response formats) will be announced in advance, and a grace period will be provided.

* Deprecated endpoints may remain operational in “Legacy Mode” for an extended time before final removal.

## 6. Testing New Versions

* Developers can test new versions in a sandbox environment before full migration.

* Greip will provide changelogs and migration documentation for major updates.

## 7. Support for Deprecated Versions

* Once an API version reaches its end-of-life (EOL), it will no longer receive bug fixes, security patches, or support.

* Paid enterprise users may request extended support for deprecated versions under a separate agreement.

## 8. Staying Updated

To ensure a seamless experience, developers should:

* ✅ Subscribe to API update notifications via their Greip dashboard.

* ✅ Regularly check the [API Changelog](https://changelog.greip.io/) for upcoming changes.

* ✅ Follow best practices for version handling in their implementation.

For any questions regarding API updates and deprecation, contact [support@greip.io](mailto:support@greip.io).

# User Data Deletion

Source: https://docs.greip.io/api-reference/endpoint/account/users/delete

DELETE /account/users/delete

In some cases, such as data protection regulations, businesses that process personal data are required to delete it upon request.

Using this method, you'll be able to delete all data related to your user in a single request.

**This action cannot be undone**, all deleted data will be deleted immediately

from our system.

User data can be deleted 2 minutes after its creation in our system.

### Body Parameters

The email address, phone number, or user ID (in your system) of the user whose

data you want to delete.

```json Success

{

"data": {

"transaction_data": 25,

"ips": 4,

"profanity_data": 3,

"emails": 1,

"phone_numbers": 1,

"ibans": 10

},

"status": "success"

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

Number of transactions or transaction related data deleted.

Number of IP addresses related data deleted.

Number of user data deleted from the usage of Profanity Detection endpint.

Number of user data deleted from the Email Scoring endpoint.

Number of user data deleted from the Phone Scoring endpoint.

Number of user data deleted from the IBAN Lookup endpoint.

The response status.

Expected values: `success`, or `error`.

# ASN Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/asn

GET /lookup/asn

This API method allows you to look up any given Autonomous System Number (ASN) and retrieve comprehensive data associated with it.

The information returned includes the ASN name, organization name, country, associated domain, contact email, phone number, and more. This functionality is essential for network analysis, troubleshooting, and understanding the infrastructure behind IP addresses.

### Query Parameters

The asn command is used to specify the AS Number you want to lookup.

Sample value: `AS6167` or `6167`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"asn": "AS6167",

"name": "CELLCO-PART",

"country": "US",

"org": "Verizon Business",

"phone": "+1-800-900-0241",

"email": "swipper@verizon.com",

"domain": "verizon.net",

"status": null,

"created": "2006-05-30",

"type": null,

"registry": null

},

"status": "success",

"executionTime": 4198

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

Autonomous System Number you're looking up.

Name of the organization.

Country code of the organization.

Organization name.

Phone number contact for the organization.

Email contact for the organization.

Domain associated with the organization.

Status of the organization.

Date of organization creation.

Type of organization ("isp", "hosting", "business", "education", or

"government").

Registration information of the organization.

Response status (`success`, or `error`).

Time taken to process the data (in milliseconds).

# BIN/IIN Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/bin

GET /lookup/bin

Utilize this module to effortlessly retrieve comprehensive information associated with a debit or credit card.

The API provides details such as card type (debit or credit), scheme (Visa, Mastercard, etc.), brand (gold, platinum, etc.), and bank information.

This data is invaluable for various applications, including verifying customer payment details, detecting fraudulent transactions, and delivering personalized services to enhance user experiences.

### Overview

The IIN (Issuer Identification Number), also known as the BIN (Bank Identification Number), is the first 6 digits of a debit or credit card number. These unique numbers are used to identify the issuing entity, such as the bank or financial institution that issued the card.

One of the most common and critical use cases of this method is to detect and prevent fraud payments in your app or website. This is an essential task for any business that accepts online payments, as fraud can lead to significant financial losses and reputational damage.

For example, based on of our case studies, if you notice a user from the UK purchasing large amounts of your product, and the card used for payment is issued by a bank located in the US, this could be a red flag. This may indicate that the user is using a stolen or fraudulent card to complete the checkout process. By flagging such transactions for review or rejection, you can prevent fraud and protect your business from financial loss.

### Query Parameters

The BIN/IIN of the card (min: 6 digits).

Sample value: `456789`, `456789XXXXXX1234`, or `4567891234567890`.

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

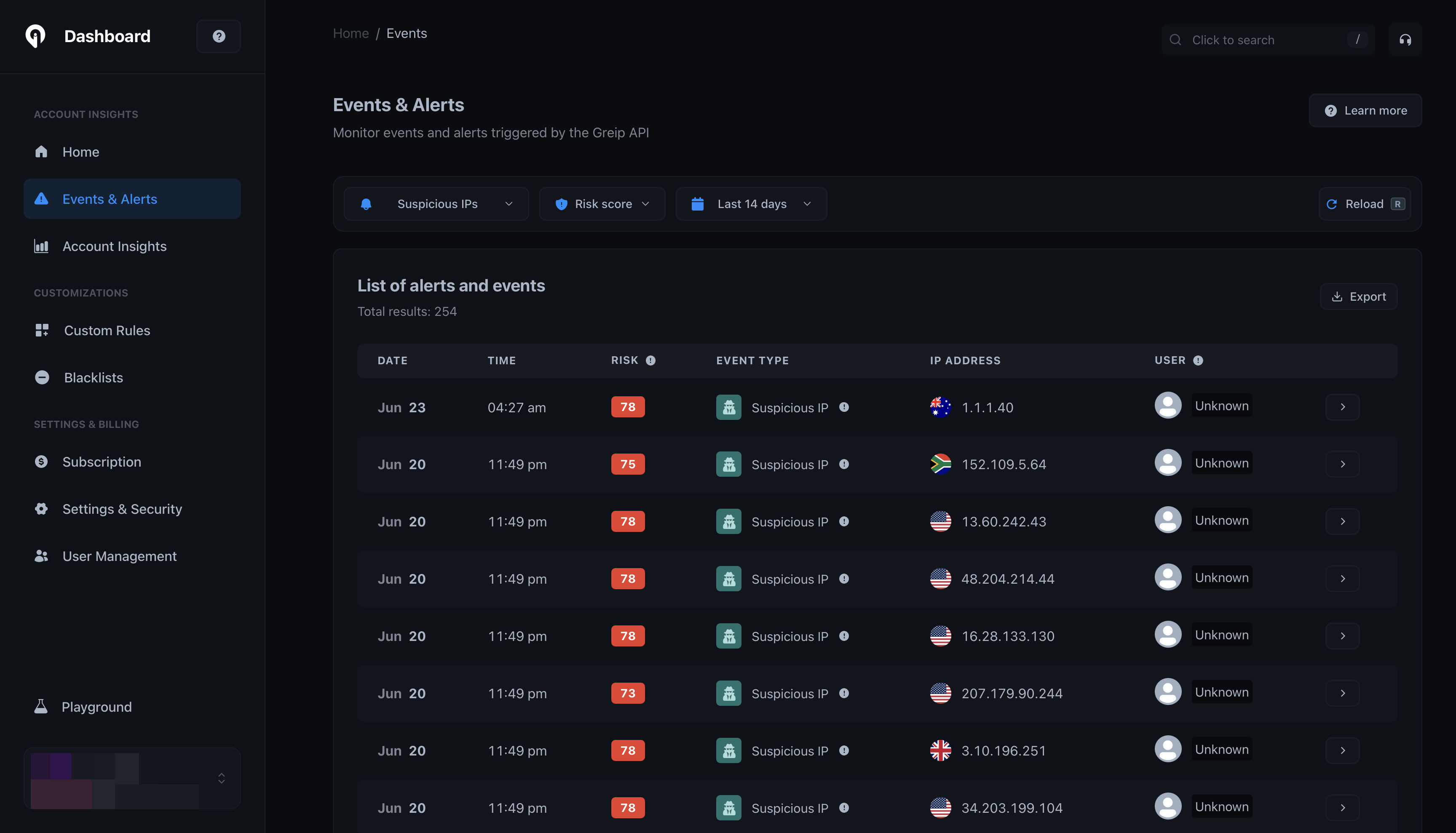

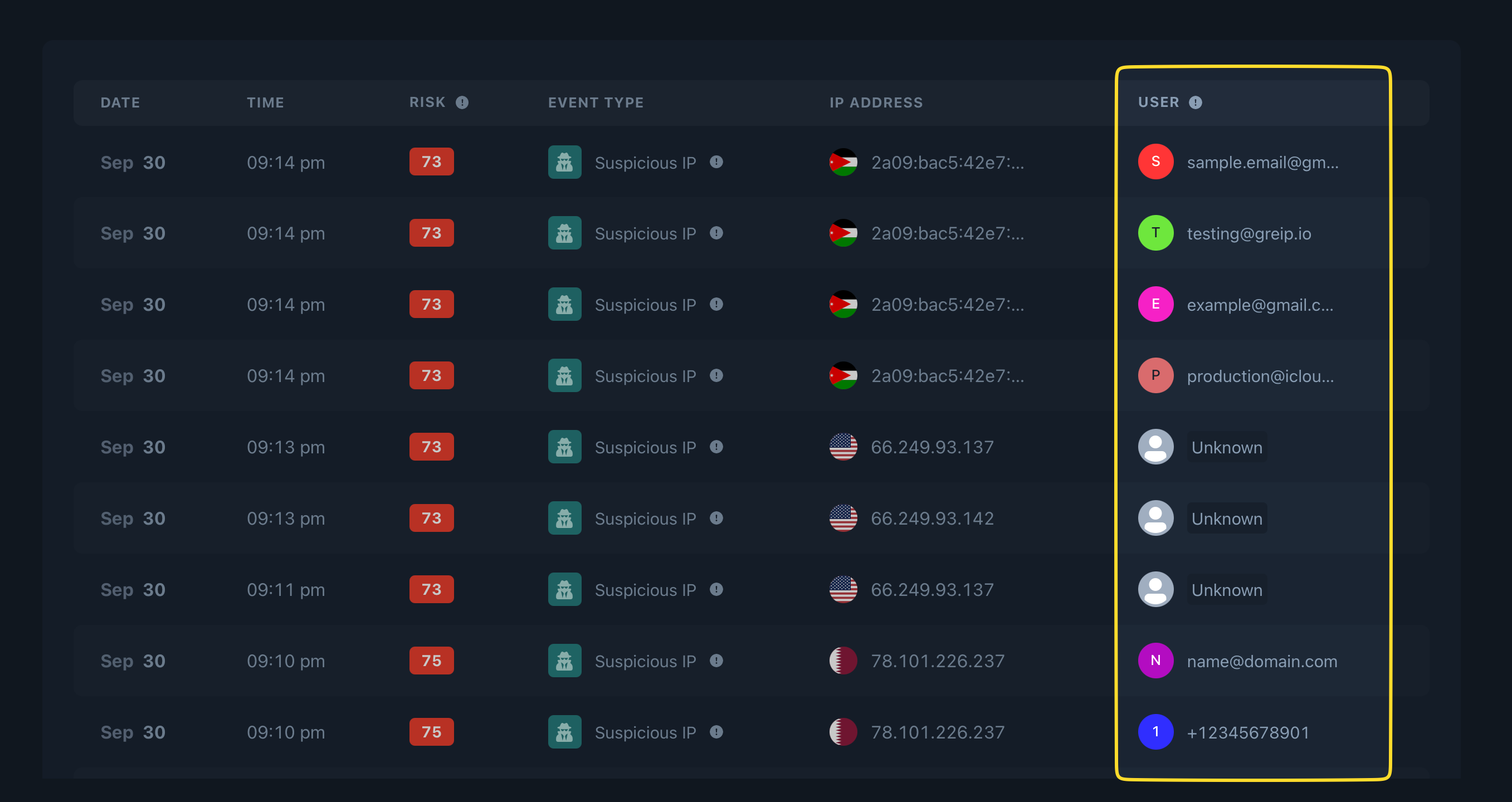

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"reason": "",

"isValid": true,

"blacklisted": false,

"bin": "456789",

"info": {

"scheme": {

"name": "Visa",

"coName": "Mada",

"isLuha": true,

"isPrepaid": false,

"isCommercial": false,

"type": "debit",

"brand": "Traditional",

"currency": "SAR"

},

"detected_digits": "4",

"syntax": {

"gaps": [4, 8, 12],

"lengths": [16, 18, 19],

"code": {

"name": "CVV",

"size": 3

}

},

"bank": {

"id": "588847",

"identifier": "80",

"name": "AL RAJHI BANKING AND INVESTMENT CORP.",

"city": "Riyadh",

"url": "https://www.alrajhibank.com.sa",

"phone": "+96611211600",

"logo": "https://greip.io/img/banks/al-rajhi.jpg",

"latitude": "25",

"longitude": "45"

},

"country": {

"alpha2": "SA",

"name": "Saudi Arabia",

"code": "966",

"numeric": "682",

"emoji": "🇸🇦",

"continent": "Asia",

"languageCode": "ar",

"languageNative": "العربية"

}

},

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 2

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

Reason for the validation result.

Validation result (`true` or `false`).

Indicates if the BIN is blacklisted due to applying [custom

rules](/knowledge-base/custom-rules/overview) or were found in one of your

blacklists.

The BIN/IIN of the card you passed in the request.

Card scheme name.

Card company name.

Is the card issued by Luha?

Is the card prepaid?

Is the card commercial?

Card type (`debit`, or `credit`).

Card brand (`Traditional`, `Gold`, `Platinum`, etc.).

Card currency.

The digits used to detect the scheme details.

The gaps variations of the card number.

The possible lengths of the card number.

The name of the code (e.g: CVV).

The number of digits in the code.

Bank ID.

Bank identifier.

The official bank name.

The city where the bank's headquarters are located.

Bank URL of the official website.

Bank phone number for contact.

Bank logo URL (image).

Bank latitude coordinates of the country where the bank is

located.

Bank longitude coordinates of the country where the bank is

located.

Country code (in ISO 3166-1 alpha-2 format).

The Country name.

Country dialing code.

Country numeric code.

Country flag emoji.

Continent where the country is located.

Country language code (in ISO 639-1 format).

Country native language name.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

Response status (`success`, or `error`).

Time taken to process the data (in milliseconds).

# Bulk IP Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/bulk-ip

GET /lookup/ip/bulk

This API enables you to retrieve information for multiple IP addresses in a single request.

By using the `/lookup/ip/bulk` method, you can efficiently gather data such as location, ISP, and risk factors for a batch of IPs, saving time and streamlining your workflow for large-scale analysis.

You can lookup upto 10 IP addresses using this method. Otherwise, you will get

an error response (Code: 118).

### Query Parameters

The ips command is used to specify the IP address you want to lookup.

Expected values: comma serarated IP addresses (IPv4 or IPv6)

Sample value: `1.1.1.1,2.2.2.2`

The params command can be used to specify the required modules you want to get

in the response.

Expected values: `security`, `currency`, `timezone`, `location`, and/or `device`

Sample value: `security,timezone,currency`

For more information please refer to [Customize response modules](/options/customize-modules).

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The lang command is used to get a response in a specific language.

Expected values: `EN`, `AR`, `DE`, `FR`, `ES`, `JA`, `ZH`, or `RU`

For more information please refer to [Localization](/options/localization).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

# Country Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/country

GET /lookup/country

This method allows you to retrieve detailed information about a country by providing its country code in the request.

The API returns valuable data, such as the country’s name, capital, population, region, and other relevant attributes, enabling you to enrich your applications with geographic context and enhance user experiences.

### Query Parameters

The `ISO 3166-1 alpha-2` format of the country code. [Learn more](https://en.wikipedia.org/wiki/ISO_3166-1_alpha-2)

Sample value: `GB`

The params command is used to determine the data you need in the response.

Expected values: `language`, `flag`, `currency`, and/or `timezone`.

Sample value: `language,currency,timezone`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"countryCode": "US",

"countryName": "United States",

"countryGeoNameID": 6252001,

"capital": "Washington, D.C.",

"population": 331000000,

"phoneCode": "1",

"currency": {

"currencyName": "United States Dollar",

"currencyCode": "USD",

"currencySymbol": "$"

},

"language": {

"name": "Portuguese",

"code": "pt",

"native": "Português"

},

"timezone": {

"name": "America/Adak",

"abbreviation": "HST",

"offset": -36000,

"currentTime": "11:51:19",

"currentTimestamp": 1643406679,

"isDST": false,

"sunInfo": {

"sunset": "08:17:34",

"sunrise": "20:08:16",

"transit": "02:12:55",

"civilTwilightBegin": "19:47:39",

"civilTwilightEnd": "08:38:10",

"nauticalTwilightBegin": "19:22:22",

"nauticalTwilightEnd": "09:03:28",

"astronomicalTwilightBegin": "18:57:01",

"astronomicalTwilightEnd": "09:28:49",

"dayLength": "11:50:42"

}

},

"flag": {

"emoji": "🇺🇸",

"unicode": "U+1F1FA U+1F1F8",

"png": {

"1000px": "https://www.gredev.io/img/flags/png1000px/us.png",

"250px": "https://www.gredev.io/img/flags/png250px/us.png",

"100px": "https://www.gredev.io/img/flags/png100px/us.png"

},

"svg": "https://www.gredev.io/img/flags/svg/us.svg"

},

"countryIsEU": false,

"countryNeighbours": "CA,MX,CU",

"tld": ".us",

"continentName": "North America",

"continentCode": "NA",

"continentGeoNameID": 6255149

},

"status": "success",

"executionTime": 0

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

# Domain Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/domain

GET /lookup/domain

This method allows you to retrieve detailed information about a domain by providing its domain name in the request.

The API returns valuable data, such as the domain’s creation date, with some risk evaluation metrics.

This endpoint still in beta stage, and it may change in the future. Currently,

helps you to look up a domain name that's already available in our automated

database. The domain names that are not available in our database will return

`null` values for all properties, but at the same time it will trigger the

automation system to start collecting data about the domain name, and it will

be available in the next 24 hours after the first request.

### Query Parameters

The fully qualified domain name (FQDN) to look up. [Learn more](https://en.wikipedia.org/wiki/Fully_qualified_domain_name)

Sample value: `example.com`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"name": "dangerous-domain.com",

"is_dangerous": true,

"is_spf": false,

"is_dmarc": false,

"is_dkim": false,

"is_mx": false,

"is_bimi": false,

"created_at": "2025-02-05",

"is_new": true

},

"status": "success",

"executionTime": 0

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

The full domain name associated with the email address (for example, `gmail.com`).

Indicates whether the domain is flagged as dangerous or suspicious, which may suggest a higher risk of fraud or abuse.

If this property is set to `true`, the domain is considered high-risk or potentially malicious. As a result, the `isValid` property will also be `false`, indicating that the email address should not be trusted for critical communications or user registrations. It is strongly recommended to block or flag such email addresses in your application workflow.

Indicates whether the domain has a valid SPF (Sender Policy Framework) record, which helps prevent email spoofing.

Indicates whether the domain has a valid DMARC (Domain-based Message Authentication, Reporting, and Conformance) record, which helps protect against email phishing and spoofing.

Indicates whether the domain has a valid DKIM (DomainKeys Identified Mail) record, which verifies the authenticity of the sender's domain.

Indicates whether the domain has valid MX (Mail Exchange) records, confirming that it is capable of receiving emails.

Indicates whether the domain has a valid BIMI (Brand Indicators for Message Identification) record, which allows brand logos to be displayed in supported email clients.

The date when the domain was first registered or created, if available.

Indicates whether the domain is new or recently registered (registered within 1 year), which may affect its reputation and trustworthiness.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

# Free Get-IP

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/free-get-ip-method

This method allows you to retrieve the IP address of your visitors or users without the need for an account or API key in Greip.

It’s a quick and easy way to access IP information, making it ideal for basic integrations or when you need to capture user IPs with minimal setup.

**Usage example**

```

https://greipapi.com/ip

```

```bash cURL

curl --request GET \

--url https://greipapi.com/ip

```

```python Python

import requests

url = "https://greipapi.com/ip"

response = requests.request("GET", url)

print(response.text)

```

```javascript Javascript

const options = { method: "GET" };

fetch("https://greipapi.com/ip", options)

.then((response) => response.json())

.then((response) => console.log(response))

.catch((err) => console.error(err));

```

```php PHP

"https://greipapi.com/ip",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "GET",

]);

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

```

```go Go

package main

import (

"fmt"

"net/http"

"io/ioutil"

)

func main() {

url := "https://greipapi.com/ip"

req, _ := http.NewRequest("GET", url, nil)

res, _ := http.DefaultClient.Do(req)

defer res.Body.Close()

body, _ := ioutil.ReadAll(res.Body)

fmt.Println(res)

fmt.Println(string(body))

}

```

```java Java

HttpResponse response = Unirest.get("https://greipapi.com/ip")

.asString();

```

```json Success

{

"data": "165.227.149.217",

"documentaion": "https://docs.greip.io",

"status": "success",

"executionTime": 0

}

```

# IP Geolocation

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/geoip

GET /geoip

This API allows you to retrieve detailed geolocation information for a visitor’s or user’s IP address.

By using the IP Geolocation method, you can access data such as the user’s country, city, ISP, and more, enabling you to personalize user experiences, enhance security, and make data-driven decisions based on geographic insights.

### Query Parameters

The params command can be used to specify the required modules you want to get

in the response.

Expected values: `security`, `currency`, `timezone`, `location`, and/or `device`

Sample value: `security,timezone,currency`

For more information please refer to [Customize response modules](/options/customize-modules).

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The lang command is used to get a response in a specific language.

Expected values: `EN`, `AR`, `DE`, `FR`, `ES`, `JA`, `ZH`, or `RU`

For more information please refer to [Localization](/options/localization).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"ip": "165.227.149.217",

"ipType": "IPv4",

"IPNumber": 2783155673,

"bogon": false,

"continentName": "Europe",

"continentCode": "EU",

"countryCode": "DE",

"continentGeoNameID": 6255148,

"countryName": "Germany",

"countryGeoNameID": 2921044,

"regionName": "Hessen",

"cityName": "Frankfurt am Main",

"zipCode": "65931",

"latitude": "50.115520",

"longitude": "8.684170",

"location": {

"capital": "Berlin",

"population": 83783942,

"language": { "name": "German", "code": "de", "native": "Deutsch" },

"flag": {

"emoji": "🇩🇪",

"unicode": "U+1F1E9 U+1F1EA",

"png": {

"1000px": "https://www.gredev.io/img/flags/png1000px/de.png",

"250px": "https://www.gredev.io/img/flags/png250px/de.png",

"100px": "https://www.gredev.io/img/flags/png100px/de.png"

},

"svg": "https://www.gredev.io/img/flags/svg/de.svg"

},

"phoneCode": "49",

"countryIsEU": true,

"countryNeighbours": "CH,PL,NL,DK,BE,CZ,LU,FR,AT",

"tld": ".de"

},

"currency": {

"currencyName": "Euro",

"currencyCode": "EUR",

"currencySymbol": "€"

},

"asn": {

"asn": "AS14061",

"name": "DIGITALOCEAN-ASN",

"org": "DigitalOcean, LLC",

"phone": "+1-347-875-6044",

"email": "noc@digitalocean.com",

"domain": "digitalocean.com",

"created": "2012-05-14",

"type": "hosting"

},

"timezone": {

"name": "Europe/Berlin",

"abbreviation": "CET",

"offset": 3600,

"currentTime": "03:33:13",

"currentTimestamp": 1709519593,

"isDST": false,

"sunInfo": {

"sunset": "18:14:11",

"sunrise": "06:59:29",

"transit": "12:36:50",

"civilTwilightBegin": "06:28:47",

"civilTwilightEnd": "18:44:53",

"nauticalTwilightBegin": "05:51:20",

"nauticalTwilightEnd": "19:22:21",

"astronomicalTwilightBegin": "05:13:27",

"astronomicalTwilightEnd": "20:00:13",

"dayLength": "11:14:42"

}

},

"security": {

"isProxy": true,

"proxyType": "VPN",

"isTor": false,

"isBot": false,

"isRelay": false,

"isHosting": true,

"blacklisted": false

},

"device": {

"isMobile": false,

"type": "desktop",

"OS": {

"type": "desktop",

"name": "MacOS",

"family": "macintosh",

"version": "Big Sur",

"title": "MacOS Big Sur",

"64bits_mode": 1

},

"browser": {

"name": "Safari",

"version": 17.2,

"versionMajor": 1,

"title": "Safari 17.2"

}

},

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 4

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

IP address you're looking up.

Type of IP address (`IPv4`, or `IPv6`).

Numeric representation of the IP address.

Indicates if the IP address is a bogon.

Name of the continent where the IP address is.

Code representation of the continent.

Code representation of the country in `ISO-3166` format.

GeoName ID of the continent.

Name of the country.

GeoName ID of the country.

Name of the region.

Name of the city.

ZIP code of the location where the IP address belong.

Latitude coordinate of the location.

Longitude coordinate of the location.

Capital city of the country.

Population of the country.

Official language of the country.

Language code in `ISO-639` format.

Native name of the language.

Flag emoji representation.

Flag Unicode representation.

URL to 1000px PNG flag.

URL to 250px PNG flag.

URL to 100px PNG flag.

URL to SVG flag.

International dialing code for the country.

Indicates if the country is in the EU.

List of neighboring countries' codes.

Top-level domain of the country.

Name of the currency.

Currency code in `ISO-4217` format.

Symbol of the currency.

Autonomous System Number.

Name of the ASN.

Organization associated with the ASN.

Phone contact for the ASN.

Email contact for the ASN.

Domain associated with the ASN.

Date of ASN creation.

Type of organization ("isp", "hosting", "business", "education", or

"government").

Timezone name.

Timezone abbreviation.

Timezone offset from UTC.

Current time in the timezone.

Current timestamp in the timezone.

Indicates if Daylight Saving Time is active.

Sunset time.

Sunrise time.

Solar transit time.

Civil twilight begin time.

Civil twilight end time.

Nautical twilight begin time.

Nautical twilight end time.

Astronomical twilight begin time.

Astronomical twilight end time.

Length of the day.

Indicates if the IP address is a proxy service.

Type of proxy used.

Indicates if accessed through Tor network.

Indicates if the user is a bot.

Indicates if it's a Apple's Private Relay connection.

Indicates if the IP address belong to a hosting provider.

Indicates if the IP address is blacklisted due to applying [custom

rules](/knowledge-base/custom-rules/overview) or were found in one of

your blacklists.

Indicates if the device is a mobile device.

Type of device.

Type of operating system.

Name of the operating system.

Family of the operating system.

Version of the operating system.

Title of the operating system.

Indicates 64-bit mode (1 for true, 0 for false).

Name of the browser.

Version of the browser.

Major version of the browser.

Title of the browser.

The user-agent of the browser.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

Response status (success/error).

Time taken to process the data (in milliseconds).

# IBAN Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/iban

GET /lookup/iban

This method enables you to validate International Bank Account Numbers (IBANs) and obtain essential information about the country associated with each IBAN.

By using this API, you can ensure that the IBANs are formatted correctly and gain insights into the banking institution, enhancing security and accuracy in financial transactions.

### Overview

The IIN (Issuer Identification Number), also known as the BIN (Bank Identification Number), is the first 6 digits of a debit or credit card number. These unique numbers are used to identify the issuing entity, such as the bank or financial institution that issued the card.

One of the most common and critical use cases of this method is to detect and prevent fraud payments in your app or website. This is an essential task for any business that accepts online payments, as fraud can lead to significant financial losses and reputational damage.

For example, if you notice a user from the UK purchasing large amounts of your product, and the card used for payment is issued by a bank located in the US, this could be a red flag. This may indicate that the user is using a stolen or fraudulent card to complete the checkout process. By flagging such transactions for review or rejection, you can prevent fraud and protect your business from financial loss.

### Query Parameters

The International Bank Account Number (IBAN) you want to validate.

Sample value: `BE71096123456769`, or `BE71 0961 2345 6769`.

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"isValid": true,

"formats": {

"machine": "BE71096123456769",

"human": "BE71 0961 2345 6769",

"obfuscated": "BE** **** **** 6769"

},

"country": {

"name": "Belgium",

"IANA": "be",

"ISO3166": "BE",

"currency": "EUR",

"centralBank": {

"url": "http://www.nbb.be/",

"name": "National Bank of Belgium"

},

"membership": "eu_member",

"isEU": true,

"length": "16",

"isSEPA": true,

"swiftOfficial": true

},

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 1

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

A boolean value that you can rely on to determine if the IBAN is valid or not.

Machine format of the IBAN.

Human-readable format of the IBAN.

Obfuscated format of the IBAN.

Country name where the issuing bank is located.

The [IANA](https://en.wikipedia.org/wiki/Internet_Assigned_Numbers_Authority) of the country.

Country code in `ISO3166` format.

Currency of the country.

The name of the central bank of the issuing country.

The URL of the central bank of the issuing country.

Membership type of the bank.

Determines whether the user is located within the European Union (EU) and is relevant for processing transactions or validations specific to EU countries.

IBAN length in this country.

Indicates whether the IBAN belongs to a country participating in the Single Euro Payments Area (SEPA)

Typically indicates whether the IBAN corresponds to an official institution or entity that is part of the SWIFT network, which facilitates international financial transactions.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

# IP Lookup

Source: https://docs.greip.io/api-reference/endpoint/data-lookup/ip

GET /lookup/ip

Use this API to retrieve comprehensive information about a given IP address. It provides details such as location, ISP, and potential risk factors, enabling you to analyze and verify IP data for enhanced security, fraud prevention, and user profiling.

### Query Parameters

The ip command is used to specify the IP address you want to lookup.

Expected values: an IP address (IPv4 or IPv6)

Sample value: `1.1.1.1`

The params command can be used to specify the required modules you want to get

in the response.

Expected values: `security`, `currency`, `timezone`, and/or `location`.

Sample value: `security,timezone,currency`

For more information please refer to [Customize response modules](/options/customize-modules).

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The lang command is used to get a response in a specific language.

Expected values: `EN`, `AR`, `DE`, `FR`, `ES`, `JA`, `ZH`, or `RU`

For more information please refer to [Localization](/options/localization).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"ip": "165.227.149.217",

"ipType": "IPv4",

"IPNumber": 2783155673,

"bogon": false,

"continentName": "Europe",

"continentCode": "EU",

"countryCode": "DE",

"continentGeoNameID": 6255148,

"countryName": "Germany",

"countryGeoNameID": 2921044,

"regionName": "Hessen",

"cityName": "Frankfurt am Main",

"zipCode": "65931",

"latitude": "50.115520",

"longitude": "8.684170",

"location": {

"capital": "Berlin",

"population": 83783942,

"language": { "name": "German", "code": "de", "native": "Deutsch" },

"flag": {

"emoji": "🇩🇪",

"unicode": "U+1F1E9 U+1F1EA",

"png": {

"1000px": "https://www.gredev.io/img/flags/png1000px/de.png",

"250px": "https://www.gredev.io/img/flags/png250px/de.png",

"100px": "https://www.gredev.io/img/flags/png100px/de.png"

},

"svg": "https://www.gredev.io/img/flags/svg/de.svg"

},

"phoneCode": "49",

"countryIsEU": true,

"countryNeighbours": "CH,PL,NL,DK,BE,CZ,LU,FR,AT",

"tld": ".de"

},

"currency": {

"currencyName": "Euro",

"currencyCode": "EUR",

"currencySymbol": "€"

},

"asn": {

"asn": "AS14061",

"name": "DIGITALOCEAN-ASN",

"org": "DigitalOcean, LLC",

"phone": "+1-347-875-6044",

"email": "noc@digitalocean.com",

"domain": "digitalocean.com",

"created": "2012-05-14",

"type": "hosting"

},

"timezone": {

"name": "Europe/Berlin",

"abbreviation": "CET",

"offset": 3600,

"currentTime": "03:33:13",

"currentTimestamp": 1709519593,

"isDST": false,

"sunInfo": {

"sunset": "18:14:11",

"sunrise": "06:59:29",

"transit": "12:36:50",

"civilTwilightBegin": "06:28:47",

"civilTwilightEnd": "18:44:53",

"nauticalTwilightBegin": "05:51:20",

"nauticalTwilightEnd": "19:22:21",

"astronomicalTwilightBegin": "05:13:27",

"astronomicalTwilightEnd": "20:00:13",

"dayLength": "11:14:42"

}

},

"security": {

"isProxy": true,

"proxyType": "VPN",

"isTor": false,

"isBot": false,

"isRelay": false,

"isHosting": true,

"blacklisted": false

},

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 4

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

IP address you're looking up.

Type of IP address (`IPv4`, or `IPv6`).

Numeric representation of the IP address.

Indicates if the IP address is a bogon.

Name of the continent where the IP address is.

Code representation of the continent.

Code representation of the country in `ISO-3166` format.

GeoName ID of the continent.

Name of the country.

GeoName ID of the country.

Name of the region.

Name of the city.

ZIP code of the location where the IP address belong.

Latitude coordinate of the location.

Longitude coordinate of the location.

Capital city of the country.

Population of the country.

Official language of the country.

Language code in `ISO-639` format.

Native name of the language.

Flag emoji representation.

Flag Unicode representation.

URL to 1000px PNG flag.

URL to 250px PNG flag.

URL to 100px PNG flag.

URL to SVG flag.

International dialing code for the country.

Indicates if the country is in the EU.

List of neighboring countries' codes.

Top-level domain of the country.

Name of the currency.

Currency code in `ISO-4217` format.

Symbol of the currency.

Autonomous System Number.

Name of the ASN.

Organization associated with the ASN.

Phone contact for the ASN.

Email contact for the ASN.

Domain associated with the ASN.

Date of ASN creation.

Type of organization ("isp", "hosting", "business", "education", or

"government").

Timezone name.

Timezone abbreviation.

Timezone offset from UTC.

Current time in the timezone.

Current timestamp in the timezone.

Indicates if Daylight Saving Time is active.

Sunset time.

Sunrise time.

Solar transit time.

Civil twilight begin time.

Civil twilight end time.

Nautical twilight begin time.

Nautical twilight end time.

Astronomical twilight begin time.

Astronomical twilight end time.

Length of the day.

Indicates if the IP address is a proxy service.

Type of proxy used.

Indicates if accessed through Tor network.

Indicates if the user is a bot.

Indicates if it's a Apple's Private Relay connection.

Indicates if the IP address belong to a hosting provider.

Indicates if the IP address is blacklisted due to applying [custom

rules](/knowledge-base/custom-rules/overview) or were found in one of

your blacklists.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

Response status (success/error).

Time taken to process the data (in milliseconds).

# Email Scoring

Source: https://docs.greip.io/api-reference/endpoint/scoring/email

GET /scoring/email

This method provides an additional layer of validation for your system. While validating email syntax is important, it is not sufficient.

This method goes beyond syntax validation by checking the domain's validity, the availability of the Mail Service, detecting Disposable Email (Temporary Emails), etc. By utilising this method, you can ensure a more thorough validation process for email addresses.

### Query Parameters

The email command is used to specify the email you want to validate.

Expected values: an email address

Sample value: `name@domain.com`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"score": 3,

"reason": "Email domain is considered dangerous.",

"isValid": false,

"isFree": false,

"isRoleBased": true,

"isEducational": false,

"isDisposable": false,

"blacklisted": false,

"email": "test@dangerous-domain.com",

"domain": {

"name": "dangerous-domain.com",

"is_dangerous": true,

"is_spf": false,

"is_dmarc": false,

"is_dkim": false,

"is_mx": false,

"is_bimi": false,

"created_at": "2025-02-05",

"is_new": true

},

"custom_rules_applied": { "total": 0, "rules": [] }

},

"status": "success",

"executionTime": 1

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

A risk-score from 0 to 3 indicating how risky this email address is

(0=safe, 1=low-risk, 2=high-risk, 3=too-risky).

The reason behind considering this email address as risky.

**Note:** The value of this property will be empty if the `score` is `0`.

Indicates whether the email address is from a free email service provider.

Indicates whether the email address is a role-based email address. Role-based email addresses are those that are associated with a particular role or group, such as `admin`, `support`, `info`, etc.

Indicates whether the email address is an educational email address.

A boolean value that you can rely on to determine if the email address is 100% safe & valid or not.

Indicates whether the email address is a disposable email address (also known as Temporary Email Addresses).

Indicates if the email/domain is blacklisted due to applying [custom

rules](/knowledge-base/custom-rules/overview) or were found in one of your

blacklists.

The information associated with the domain name of the email address.

The full domain name associated with the email address (for example, `gmail.com`).

Indicates whether the domain is flagged as dangerous or suspicious, which may suggest a higher risk of fraud or abuse.

If this property is set to `true`, the domain is considered high-risk or potentially malicious. As a result, the `isValid` property will also be `false`, indicating that the email address should not be trusted for critical communications or user registrations. It is strongly recommended to block or flag such email addresses in your application workflow.

Indicates whether the domain has a valid SPF (Sender Policy Framework) record, which helps prevent email spoofing.

Indicates whether the domain has a valid DMARC (Domain-based Message Authentication, Reporting, and Conformance) record, which helps protect against email phishing and spoofing.

Indicates whether the domain has a valid DKIM (DomainKeys Identified Mail) record, which verifies the authenticity of the sender's domain.

Indicates whether the domain has valid MX (Mail Exchange) records, confirming that it is capable of receiving emails.

Indicates whether the domain has a valid BIMI (Brand Indicators for Message Identification) record, which allows brand logos to be displayed in supported email clients.

The date when the domain was first registered or created, if available.

Indicates whether the domain is new or recently registered (registered within 1 year), which may affect its reputation and trustworthiness.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

## What can I expect from this API?

* Detection of disposable email addresses (also known as Temporary Email Addresses)

* Detection of free email service providers

* Detection of role-based email addresses

* Testing the email service provider of a given email address

* Validation of email syntax

# IP Reputation

Source: https://docs.greip.io/api-reference/endpoint/scoring/ip-reputation

GET /lookup/ip/threats

Access comprehensive threat intelligence data linked to a specific IP address. This endpoint provides insights into malicious activity, reputation scoring, and potential security risks associated with the IP address.

### Query Parameters

The ip parameter is used to specify the IP address you want to retrieve it's threat intelligence information.

Expected values: an IP address (IPv4 or IPv6)

Sample value: `1.1.1.1`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"status": "success",

"data": {

"ip": "12.12.12.12",

"threats": {

"isProxy": true,

"proxyType": "Socks",

"isTor": false,

"isBot": false,

"isRelay": false,

"isHosting": true,

"blacklisted": false

},

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"executionTime": 90

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

IP address you're looking up.

Indicates if the IP address is a proxy service.

Type of proxy used.

Indicates if accessed through Tor network.

Indicates if the user is a bot.

Indicates if it's a Apple's Private Relay connection.

Indicates if the IP address belong to a hosting provider.

Indicates if the IP address is blacklisted due to applying [custom

rules](/knowledge-base/custom-rules/overview) or were found in one of

your blacklists.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

Response status (success/error).

Time taken to process the data (in milliseconds).

# Payment Fraud Detection

Source: https://docs.greip.io/api-reference/endpoint/scoring/payment

POST /scoring/payment

Prevent financial losses and protect your business by deploying AI-powered modules that analyze transaction patterns in real-time.

This method helps identify and block suspicious activities, mitigating the risk of fraudulent payments and ensuring a secure experience for both you and your customers.

## Overview

Detecting and preventing fraudulent payments is a critical task for any business that accepts online payments. This AI-based module is designed to help you do that by analysing a range of data points related to each transaction.

Using sophisticated machine learning algorithms, this method can detect and flag potentially fraudulent transactions by analysing user data, user behaviour, user device, and other factors. For example, if a transaction appears to be coming from an unusual location or device, or if the user's behaviour is inconsistent with their past transactions, this method can flag the transaction for further review or rejection.

One of the key advantages of this AI-based module is its ability to adapt and learn over time. As it analyses more data and detects more fraud, it can improve its accuracy and efficiency, making it a highly effective tool for preventing financial losses due to fraud.

By implementing this method in your payment processing system, you can help protect your business and your customers from fraudulent activity, while providing a seamless and secure payment experience.

"ECOMMERCE LOSSES TO ONLINE PAYMENT FRAUD TO **EXCEED \$48 BILLION** GLOBALLY

IN 2023, AS FRAUD INCURSIONS EVOLVE", according to a recent report by Juniper

Research.

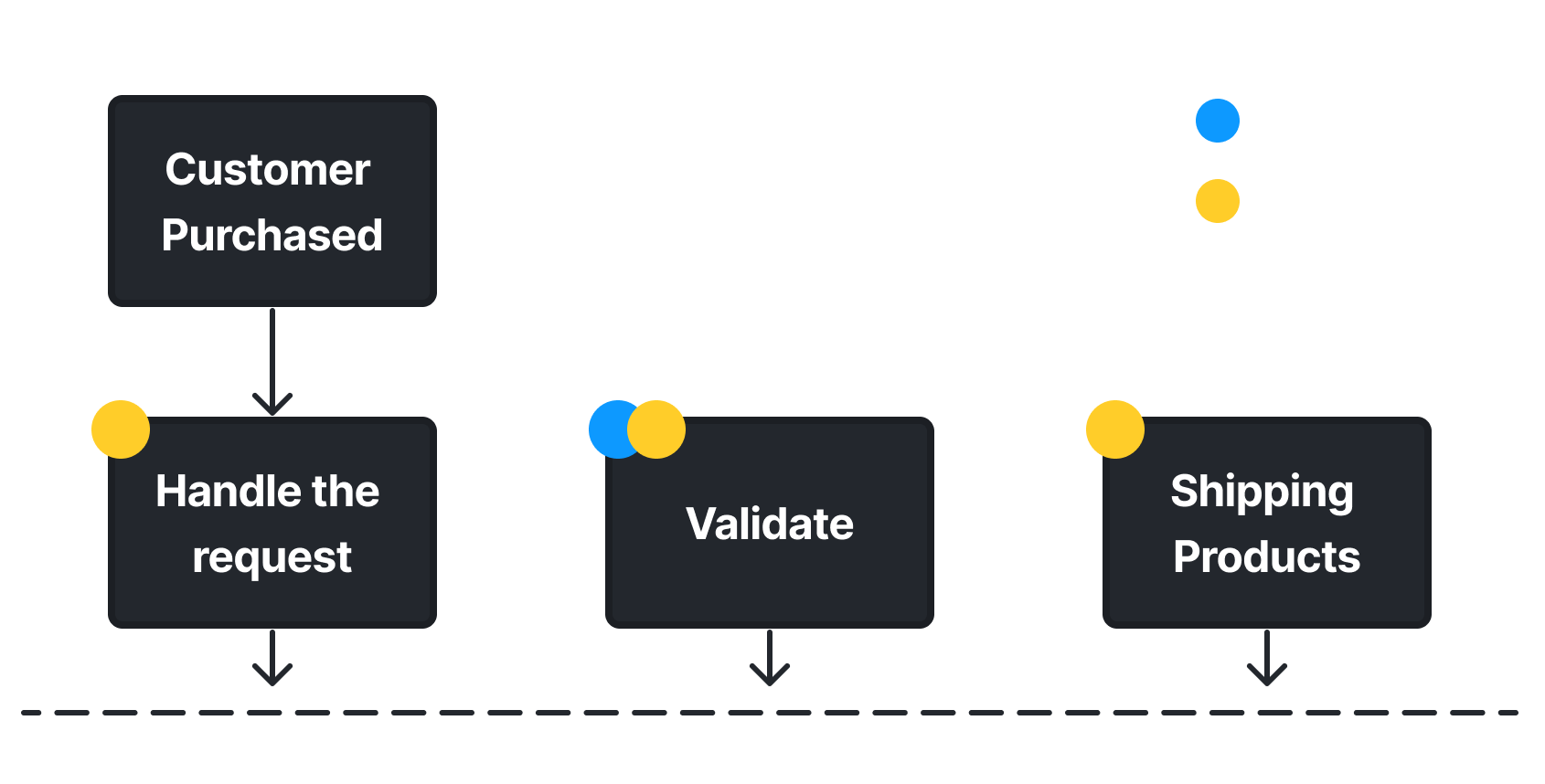

## Integration Workflow

### Body Parameters

The action your customer try to implement.

Accepts: `purchase`, `deposit`, or `withdrawal`.

The domain name of the website the customer trying to purchase from.

Sample value: `domain.com`

The name of the website the customer trying to purchase from.

Sample value: `Nike Store, California`

If your a service provider with "sub-websites" (like Shopify), then provide a unique identification code indicating the website the customer trying to purchase from.

Sample values: `12330098`, `01as-aowq-029jd`, or `abcdefg`.

The identification code of the shipment.

The identification code of the transaction in your system.

The total amount of the transaction.

The currency in which the customer pay with.

Sample value: `GBP`

Set this to true if the customer is purchasing a digital product.

The promo code used by the customer to complete the checkout.

The identification number of the customer in your system.

The first name of the customer.

The last name of the customer (Family Name).

The Place of Birth of the customer.

The IP address of the customer.

The `ISO 3166-1 alpha-2` code format of the country where the customer live. [Learn more](https://en.wikipedia.org/wiki/ISO_3166-1_alpha-2)

The name of the region where the customer live.

The name of the city where the customer live.

The name of the zip code of customer location.

The "address line 1" of the customer.

The "address line 2" of the customer.

The customer latitude on the map (GPS Coordinates).

The customer longitude on the map (GPS Coordinates).

The device identification code of the customer.

The phone number of the customer (international format).

The registration date of the customer (UNIX Timestamp).

If you offer a Wallet feature in your website, then pass the user balance to this pararmeter.

The customer's date of birth.

Sample value: '1985-12-27\`

The email address of the customer.

Set this to true if the customer has 2FA enabled in his/her account.

Pass the [User Agent](https://en.wikipedia.org/wiki/User_agent) of the customer to this parameter.

The shipping country code of the customer (in `ISO 3166-1 alpha-2` format).

The shipping region name of the customer.

The shipping city name of the customer.

The zip code of the customer's shipping address.

The shipping "address 1" of the customer.

The shipping "address 2" of the customer.

The latitude of the customer's shipping address (GPS Coordinates).

The longitude of the customer's shipping address (GPS Coordinates).

The billing country code of the customer (in `ISO 3166-1 alpha-2` format).

The billing region name of the customer.

The billing city name of the customer.

The zip code of the customer's billing address.

The billing "address 1" of the customer.

The billing "address 2" of the customer.

The latitude of the customer's billing address (GPS Coordinates).

The longitude of the customer's billing address (GPS Coordinates).

The payment method used to complete this transaction.

Accepted values: `cards`, `cards_mada`, `applepay`, `stcpay`, `bank`, `crypto`, `wallet`, or `cod`.

The name on the card (Cardholder Name).

The card number (min: 6 digits).

The expiry date of the customer debit/credit card.

Sample value: 29/05

Set this to true if the customer passed the CVV/CSV verification process.

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

```json Success

{

"data": {

"score": 82,

"rules": [

{

"id": "PF10003",

"description": "Customer IP Address is probably VPN/Proxy/Bot/Hosting/Cloud."

},

{

"id": "PF10004",

"description": "Customer Email Address is probably invalid or spam."

},

{

"id": "PF10001",

"description": "High purchase rate, according to `customer_ip`."

},

{

"id": "PF10002",

"description": "High purchase rate, according to `customer_id`."

},

{

"id": "PF10013",

"description": "Customer device might not be a real device (according to `customer_useragent`)."

},

{

"id": "PF10014",

"description": "Customer device is registered as a high-risk device (according to `customer_useragent`)."

}

],

"rulesChecked": 21,

"rulesDetected": 6,

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 5

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

A risk-score from 0 to 100 indicating how risky this transaction is

(`10.5` means it's `10.5% risky` to pass this transaction).

The Id of the detected rule. (`10.5` means it's `10.5% risky` to pass

this transaction).

Sample value: `PF10003`

The full description of the detected rule.

Sample value: `High purchase rate, according to "customer_id".`

Total rules checked against the transaction.

Total rules detected in the transaction.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

## Possible Rules

| Id | Description |

| ------- | --------------------------------------------------------------------------------------------------------------------------------------- |

| PF1001 | High purchase rate, according to `customer_ip`. |

| PF1002 | High purchase rate, according to `customer_id`. |

| PF1003 | Customer IP Address is probably VPN/Proxy/Bot/Hosting/Cloud. |

| PF1004 | Customer Email Address is probably invalid, disposable or spam. |

| PF1005 | Customer Phone Number is probably invalid or spam. |

| PF1006 | Customer Latitude/Longitude is invalid. |

| PF1007 | Customer card number (BIN/IIN) is invalid. |

| PF1008 | Customer debit/credit card issued by a brand different from the one exist in `payment_type` parameter. |

| PF1009 | Customer country is a high-fraud country. |

| PF1010 | Customer debit/credit card issued in a high-risk country. |

| PF1011 | Customer is purchasing multiple times from multiple locations within the past 30 days. |

| PF1012 | Customer debit/credit card is being used multiple times from multiple customer accounts (according to `customer_id` and `card_number`). |

| PF1013 | Customer device might not be a real device (according to `customer_useragent`). |

| PF1014 | Customer device is registered as a high-risk device (according to `customer_useragent`). |

| PF1015 | AI flagged the transaction as potentially fraudulent. |

| PF1016 | AI flagged the transaction as potentially fraudulent due to high transaction amount. |

| PF1017 | Mismatch between billing address and IP geolocation. |

| PF1018 | Customer has multiple fraudulent transactions in the past 30 days. |

| PF1019 | Unusual purchase amount compared to customer’s history. |

| PF1020 | Transaction initiated from a newly created account. |

| PF10021 | Multiple payment cards used by a single account within a short timeframe. |

| PF10022 | Customer IP address were found in one of your blacklists. |

| PF10023 | Customer email address were found in one of your blacklists. |

| PF10024 | Customer phone number were found in one of your blacklists. |

| PF10025 | Customer card number were found in one of your blacklists. |

| PF10026 | Customer Id were found in one of your blacklists. |

# Phone Number Scoring

Source: https://docs.greip.io/api-reference/endpoint/scoring/phone

GET /scoring/phone

This method serves as an additional layer of protection in your system for validating phone numbers. It not only checks the syntax but also assesses the likelihood of the phone number being valid and operational.

By incorporating this scoring into your workflow, you can enhance fraud detection, reduce invalid inputs, and improve the overall quality of data captured.

### Query Parameters

The phone command is used to specify the phone number you want to validate.

Expected values: a phone number

Sample value: `+12121234567`, `0012121234567`, `12121234567`, or `2121234567`

The `ISO 3166-1 alpha-2` format of the country code of the phone number. [Learn more](https://en.wikipedia.org/wiki/ISO_3166-1_alpha-2)

Sample value: `US`

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, `CSV`, or `Newline`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The userID command can be used to identify requests sent by specific users to monitor in the [Events Page](/dashboard-guides/monitoring-capabilities/real-time-threat-monitoring).

Expected values: email address, phone number, user id, name, etc.

For more information please refer to [User Identifier](/options/user-identifier).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"carrier": "",

"reason": "Invalid phone number structure.",

"isValid": false,

"custom_rules_applied": {

"total": 0,

"rules": []

}

},

"status": "success",

"executionTime": 1

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

Carrier name of the phone number.

The reason behind considering this phone number as risky.

**Note:** The value of this property will be empty if the `isValid` is `true`.

A boolean value that you can rely on to determine if the phone number is 100% safe & valid or not.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The total number of custom rules applied to this request.

The custom rules applied to this request, [learn

more](/knowledge-base/custom-rules/overview).

The rule ID as shown in the dashboard (e.g: `CR104`).

The rule title you set when creating the rule.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

## What can I expect from this API?

* Detection of disposable email addresses (also known as Temporary Email Addresses)

* Testing the email service provider of a given email address

* Validation of email syntax

# Profanity Detection

Source: https://docs.greip.io/api-reference/endpoint/scoring/profanity

GET /scoring/profanity

This method helps safeguard your website or app by detecting offensive or inappropriate language in user inputs. By screening for profanity and other harmful content before it’s made public, you can maintain a positive user environment, protect your brand, and prevent abusive behavior on your platform.

This method uses Machine Learning (ML) to analyze text and determine whether it contains profanity. It returns a score for the text you pass, classifying it as safe or risky.

### Query Parameters

The text you want to filter

Sample value: `This is a sample text without profanity!`

Returns only the score of the text and whether it's safe or not.

Expected values: `yes`, or `no`.

Used to list the bad words in an array.

Expected values: `yes`, or `no`.

The format command is used to get a response in a specific format.

Expected values: `JSON`, `XML`, or `CSV`

For more information please refer to [Response Format](/options/response-format).

The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.

Expected values: `live`, or `test`.

For more information please refer to [Development Environment](/options/development-environment).

The callback command can help you make the response as a JSONP format.

Expected values: any name that can be used as a function name in Javascript, e.g: `myFunctionName`.

For more information please refer to [JSONP Callback](/options/jsonp-callback).

```json Success

{

"data": {

"isML": true,

"text": "This is just a normal text",

"totalBadWords": null,

"riskScore": 0,

"isSafe": true,

"status": "success",

"executionTime": 120

}

}

```

```json Error

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

### Response properties

A boolean value that indicates whether the detection is done by Machine Learning or not.

The text you passed to the API.

The total number of profane words found in the text.

**Note:** This field is only available when `isML` is `true`, otherwise you'll get `null`.

The risk score of the text you passed.

A boolean value that indicates whether the text is safe or not.

The response status.

Expected values: `success`, or `error`.

Time spent in milliseconds to process the data.

This method returns a score for the text you pass.

We classify profanity into 4 different level. The first level contains the most risky words and phrases (risky). The second level contains the medium-risk words and phrases. Whereas, the third level contains the low-risk words.

When you use the API, the response will the determine the score of the text you passed as follows:

* `riskScore = 0` means that this text is completely safe.

* `riskScode = 1` means that this is a high-risk text.

* `riskScode = 2` means that this is a medium-risk text.

* `riskScode = 3` means that this is a low-risk text.

# Authentication

Source: https://docs.greip.io/authentication

Authentication to Greip API made easy!

To access our API and take advantage of all the available methods, you will need to authenticate your requests using your unique API Key. This key is a secure authentication mechanism that ensures only authorized users can access the API.

To obtain your API Key, simply navigate to your [account dashboard](https://dashboard.greip.io/home). Once you have your API Key, you can begin authenticating your requests.

To authenticate your requests, append the key parameter to the request URL, along with your API Key. Here is an example of how to do this:

Add your API Key to the key parameter just like this:

```bash

https://greipapi.com/geoip?key=1234567890

```

Or, you can use the API Key as a Bearer Token as follows:

```bash cURL

curl --request GET \

--url https://greipapi.com/geoip \

--header 'Authorization: Bearer '

```

## Securing your API Key

For more information about how to secure your API Key, please refer to [Protecting your API Key]()

# Error Codes

Source: https://docs.greip.io/error-codes

List of any error you might get while using Greip API

Although we strive to provide a seamless and reliable experience, sometimes things can go wrong. In the event of an error, our API provides an error response that contains helpful information to assist you in resolving the issue.

The error response includes the `status`, `code`, `type`, and `description` of the error. The status indicates the general category of the error, while the `code` and `type` provide more specific information about the error.

The `description` property provides a detailed explanation of the error and may include suggestions for resolving the issue.

Here is an example of an error response:

```json

{

"status": "error",

"code": 101,

"type": "invalid_key",

"description": "The API Key is missing or invalid."

}

```

## Error codes

| Code | Type | Description |

| ---- | ----------------------------- | ------------------------------------------------------------------------------------------------------------------------------ |

| 101 | `invalid_key` | The API Key is missing or invalid. |

| 102 | `inactive_user` | The API Key owner (the account) is inactive right now. Please contact the support team for more information. |

| 103 | `limit_reached` | You reached the usage limit of your account. Please upgrade your subscription or pay any unpaid invoices. |

| 104 | `invalid_params` | Please check out the parms parameter's value. |

| 105 | `plan_expired` | Your plan has expired. Renew the subscription to enable using the API. |