Payment Fraud Detection

Risk Scoring

Payment Fraud Detection

Prevent financial losses and protect your business by deploying AI-powered modules that analyze transaction patterns in real-time.

This method helps identify and block suspicious activities, mitigating the risk of fraudulent payments and ensuring a secure experience for both you and your customers.

POST

Payment Fraud Detection

Overview

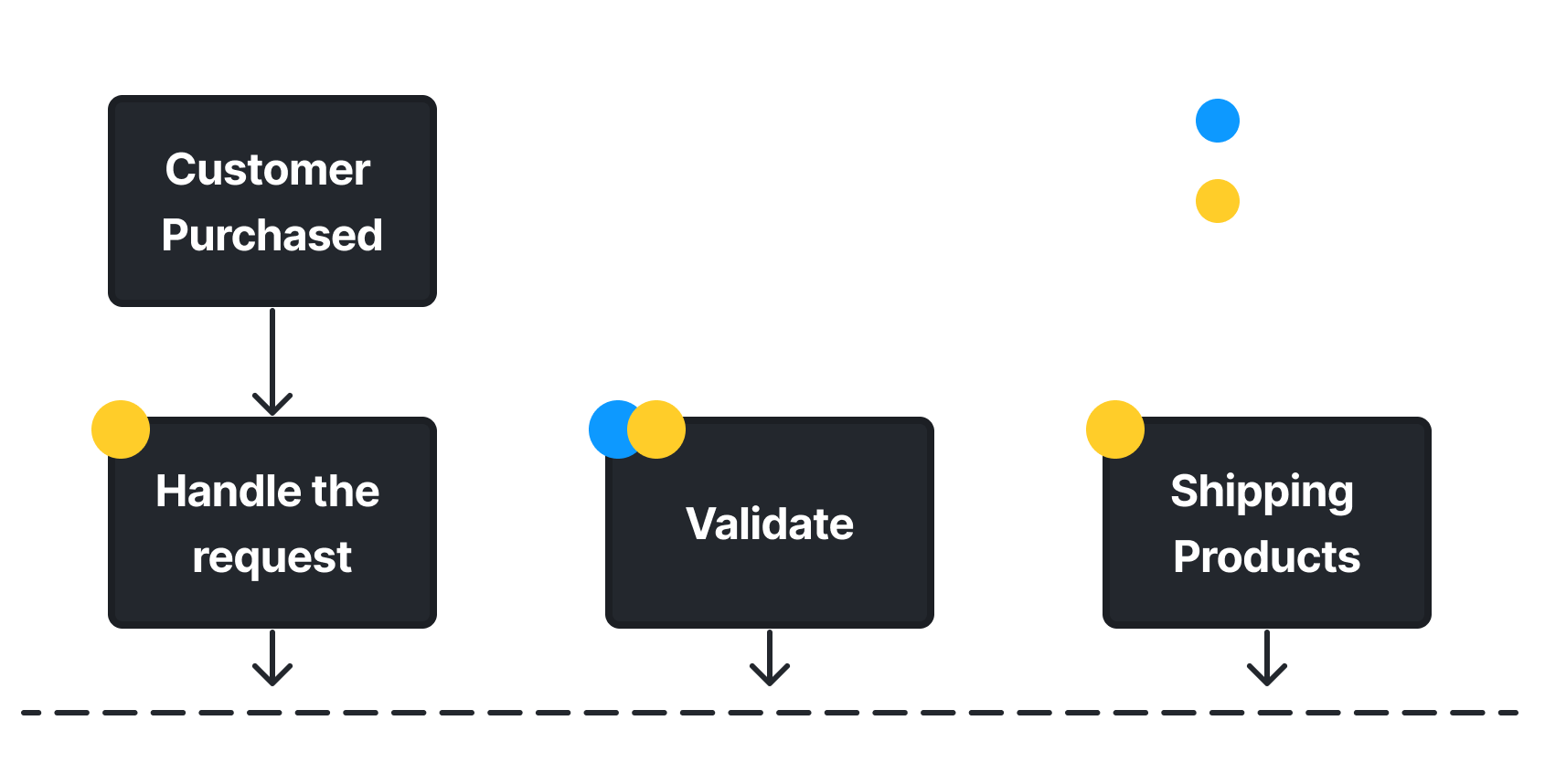

Detecting and preventing fraudulent payments is a critical task for any business that accepts online payments. This AI-based module is designed to help you do that by analysing a range of data points related to each transaction. Using sophisticated machine learning algorithms, this method can detect and flag potentially fraudulent transactions by analysing user data, user behaviour, user device, and other factors. For example, if a transaction appears to be coming from an unusual location or device, or if the user’s behaviour is inconsistent with their past transactions, this method can flag the transaction for further review or rejection. One of the key advantages of this AI-based module is its ability to adapt and learn over time. As it analyses more data and detects more fraud, it can improve its accuracy and efficiency, making it a highly effective tool for preventing financial losses due to fraud. By implementing this method in your payment processing system, you can help protect your business and your customers from fraudulent activity, while providing a seamless and secure payment experience.Integration Workflow

Body Parameters

The format command is used to get a response in a specific format.Expected values:

JSON, XML, CSV, or NewlineFor more information please refer to Response Format.The mode command is used to in the development stage to simulate the integration process before releasing it to the production environment.Expected values:

live, or test.For more information please refer to Development Environment.The userID command can be used to identify requests sent by specific users to monitor in the Events Page.Expected values: email address, phone number, user id, name, etc.For more information please refer to User Identifier.

Response properties

Possible Rules

| Id | Description |

|---|---|

| PF1001 | High purchase rate, according to customer_ip. |

| PF1002 | High purchase rate, according to customer_id. |

| PF1003 | Customer IP Address is probably VPN/Proxy/Bot/Hosting/Cloud. |

| PF1004 | Customer Email Address is probably invalid, disposable or spam. |

| PF1005 | Customer Phone Number is probably invalid or spam. |

| PF1006 | Customer Latitude/Longitude is invalid. |

| PF1007 | Customer card number (BIN/IIN) is invalid. |

| PF1008 | Customer debit/credit card issued by a brand different from the one exist in payment_type parameter. |

| PF1009 | Customer country is a high-fraud country. |

| PF1010 | Customer debit/credit card issued in a high-risk country. |

| PF1011 | Customer is purchasing multiple times from multiple locations within the past 30 days. |

| PF1012 | Customer debit/credit card is being used multiple times from multiple customer accounts (according to customer_id and card_number). |

| PF1013 | Customer device might not be a real device (according to customer_useragent). |

| PF1014 | Customer device is registered as a high-risk device (according to customer_useragent). |

| PF1015 | AI flagged the transaction as potentially fraudulent. |

| PF1016 | AI flagged the transaction as potentially fraudulent due to high transaction amount. |

| PF1017 | Mismatch between billing address and IP geolocation. |

| PF1018 | Customer has multiple fraudulent transactions in the past 30 days. |

| PF1019 | Unusual purchase amount compared to customer’s history. |

| PF1020 | Transaction initiated from a newly created account. |

| PF10021 | Multiple payment cards used by a single account within a short timeframe. |

| PF10022 | Customer IP address were found in one of your blacklists. |

| PF10023 | Customer email address were found in one of your blacklists. |

| PF10024 | Customer phone number were found in one of your blacklists. |

| PF10025 | Customer card number were found in one of your blacklists. |

| PF10026 | Customer Id were found in one of your blacklists. |